Home \ International \ Survey reveals European equipment boom and changing buying & selling trends

Survey reveals European equipment boom and changing buying & selling trends

14/05/2021

Pubblicato da Redazione

Around 200 construction businesses were surveyed by Ritchie Bros., representing companies from across Germany, The Netherlands, France, and the UK.

Many construction businesses across Europe are gearing up for an upturn in productivity this year by adding to their equipment fleets, moving towards online buying and selling and looking to credible data to support their fleet management.

These trends were all highlighted during a recent customer survey conducted by Ritchie Bros. Around 200 construction businesses were surveyed by Ritchie Bros., representing companies from across Germany, The Netherlands, France, and the UK, with fleets ranging between 2-200 equipment items and trucks.

Following the Covid-19 pandemic-related slump in productivity, which hit almost all European regions in 2020, a large majority of Ritchie Bros.’ surveyed construction businesses expressed optimism over increasing productivity this year. Whilst 95% of the respondents stated that Covid-19 had affected decisions over adding or removing machinery from their fleets, most of these companies are now looking forward to a more profitable 2021 as projects across the regions gather momentum and order books grow.

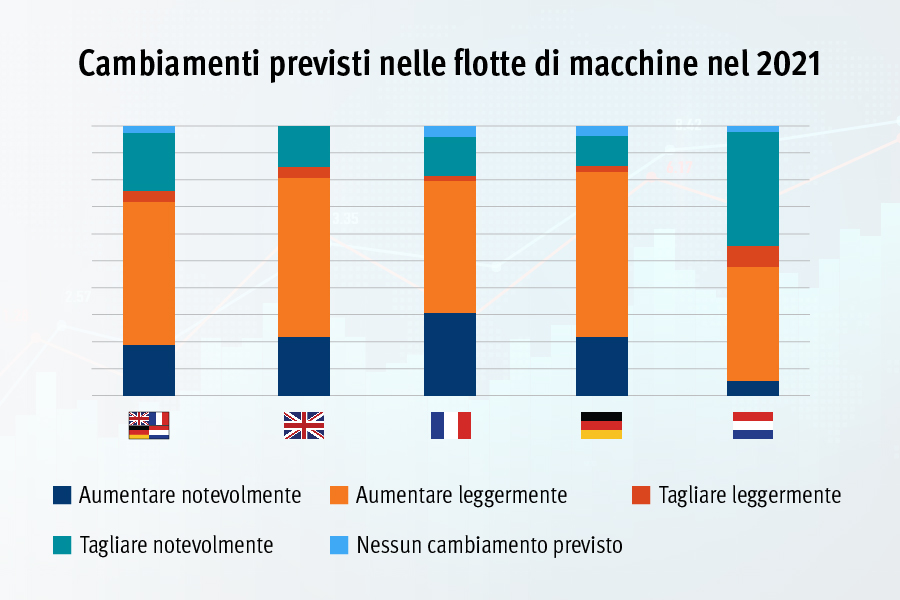

“This is clearly reflected all over Europe in what we see at our auctions and marketplaces,” said Jeroen Rijk, Managing Director at Ritchie Bros. “Many businesses are experiencing high equipment utilization, often looking to add or replace machinery they can put to work. International equipment demand is surging, leading to record numbers of bidders participating and strong price performance.” More than 70% of the surveyed construction businesses are looking to increase their heavy equipment fleet over the year, with 19% even looking to upscale their fleet “significantly.” As companies look to balance their fleet for future work requirements, the top two reasons provided in the survey to sell units are ‘Different machines needed’ and ‘Current machines are getting too old’. A third driver for disposing of machinery was the increasing maintenance cost, especially among survey respondents from The Netherlands, Germany, and France.

The survey also displayed a shift in heavy machinery buying and selling habits from traditional in-person to online transactions. Whilst this was influenced by business conduct during Covid-19, respondents recognized it widely as a replacement for more conventional face-to-face methods, post-pandemic.

Nearly 90% of the respondents are comfortable buying equipment online, with 13% even planning to make all their machinery purchases in 2021 online. More than 10% said they preferred a personal visit to buy the equipment they need. When it comes to selling machinery, a similarly high 84% would be comfortable taking care of it online, with nearly 43% expecting to facilitate more than half of their machinery dispositions through digital channels.

The research showed that buying and selling machinery online was seen as a good replacement for in-person methods for 71% of all participating construction businesses. However, there was divided opinion among UK respondents, with only 47% agreeing that buying and selling online being a suitable replacement for offline methods, such as dealer visits or attending live onsite auctions. What stood out in the survey was that construction businesses from France were deeply in favour of handling fleet adjustments online, with 58% not even considering doing it offline in 2021.

Generally, these outcomes align with Ritchie Bros.’s own experience of the behavioural changes in the equipment market. The Company’s online activity increased dramatically during 2020, with website traffic up 13% over the year with more than 140,500,000 visits, online bidder registrations up 77% to 1.2 million bidders, and accepted bids increasing by 65% to 15 million.

Although most of all the respondents in each category favoured online as a replacement over face-to-face for future transactions, traditional methods were still valued by smaller companies with 2-3 items fleets. A massive 92% still strongly valued buying and selling in-person. The findings demonstrate that despite trend changes in the way business is conducted over the pandemic and whilst digital transactions may be seen as the way forward, there is a need for fully integrated online/in-person services, particularly for smaller construction businesses.

Jeroen Rijk added: “Digital may be the new norm, but we’re not talking about ordering a new pair of shoes on your favourite website. We’re dealing with valuable industrial assets, complex international logistics and bottom-line revenues that need to be green for our customers. No matter how powerful the technology is, you’ll always need good people and physical locations to facilitate the best results.”

Over the last 6 months, Ritchie Bros. added several smaller equipment yards in Europe to offer a more tailored service to customers located further away from its main auction sites. Rijk continues: “Bringing our services closer to customers means it’s easier to sell, they have lower cost and more personalized services. We take custody of the items. They can deliver and store machinery for sale in our auction or marketplace. Our auction technology and marketing power enable the seller to reach global buyers closer to home. End of the day, the personal connection between customer and our staff is really the heartbeat of the whole operation.”

The growth of online equipment sales has led to an explosion of data. In parallel, the equipment owners are looking for heavy equipment data to base fleet management decisions on. Fresh market insights, equipment price performance and the ability to identify high-demand regions enable the equipment owner to mitigate risks and bring clarity in fleet management.

Rijk concludes: “Many construction businesses right now are focused on their jobs, and we frequently see they’re storing idle machinery in the corner of their yards. Or we see they’re challenged with efficiently replacing units with newer ones. All units, old or new, have a value in the market, and their owners are looking for ways to optimize return on investment. Using data models and tools, we can see what the market is doing for particular asset groups and adjust the customer’s selling strategy accordingly to optimize returns.”

Ultime notizie di OnSite News

Earthmoving Machinery

25/11/2024

Prinoth Unveils Expanded Production Facility in Granby, Canada

Prinoth held an event to announce the official opening of it...

Logistics

22/11/2024

Sarens acquires additional SCHEUERLE SPMT K24 modules

renowned for its expertise in crane rental services, heavy l...

Equipments

21/11/2024

SITECH partners with Royal Engineers to create poppy and demonstrate tech offering

The demostration involved creating a ground-level poppy desi...

Earthmoving Machinery

20/11/2024

Strong and stable RA30 trucks carry the weight at New Caledonian mine

Three Rokbak RA30 trucks are delivering exceptional durabili...

Lifting

20/11/2024

Tadano AC 7.450-1 Performs Double Duty in Wisconsin

A cost-saving and versatile solution was already on site - a...

Lifting

11/11/2024

Tadano AC 7.450-1 all terrain crane for the Victoria Tower in Mannheim

Tadano AC 7.450-1 all terrain crane lifts cooling unit to to...

Altri International

International

26/11/2024

Mota-Engil orders 10 Liebherr railroad excavators for a major project in West Africa

The Portuguese construction company Mota-Engil has once agai...

International

25/11/2024

New Grove GMK3060L-1 drives busy schedule for Mann Crane Hire

• Mann Crane Hire selected the GMK3060L-1 for its class-lead...

International

25/11/2024

Prinoth Unveils Expanded Production Facility in Granby, Canada

Prinoth held an event to announce the official opening of it...

International

23/11/2024

GPMat International takes delivery of two Raimondi T147s residential development in the South of France

- Official agent of France expands its product lineup with t...

International

22/11/2024

Sarens acquires additional SCHEUERLE SPMT K24 modules

renowned for its expertise in crane rental services, heavy l...

International

22/11/2024

Five WOLFF cranes modernize Oslo’s Ulven district

With a total of five WOLFF cranes of type 7534.16 Clear, Wol...